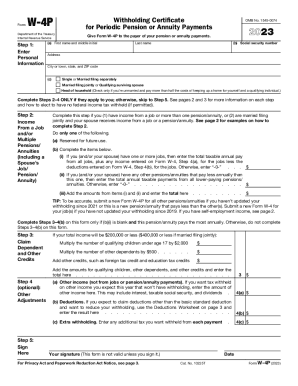

IRS W-4P 2024-2025 free printable template

Show details

Don will not enter any amounts in Step 2. amount on this Form W-4P because he entered the 1 000 on the Form W-4P for the higher paying 75 000 pension. Example 4. 9235 is over 160 200. Payments to nonresident aliens and foreign estates. Do not use Form W-4P. See Pub. Ann a single filer is completing Form W-4P for a 25 000 a year and another pension that pays 20 000 a year. See Pub. 505 for more information. Add lines 3 through 5. Enter the result here and in Step 4 b on Form W-4P. He will make...

pdfFiller is not affiliated with IRS

Understanding and Utilizing the IRS W-4P Form

Step-by-Step Instructions for Adjusting Your W-4P

Guidelines for Completing the IRS W-4P Form

Understanding and Utilizing the IRS W-4P Form

The IRS W-4P form is crucial for individuals receiving pension or annuity payments, as it allows them to manage tax withholding effectively. Completing this form accurately ensures that you withhold the correct amount of federal income tax from your payments, which helps in avoiding unexpected tax liabilities at year-end.

Step-by-Step Instructions for Adjusting Your W-4P

01

Begin by downloading the latest W-4P form from the IRS website to ensure compliance with current regulations.

02

Fill in your personal information, including your name, address, and Social Security number, in the designated fields.

03

Indicate the type of payment you are receiving—whether it be from pensions, annuities, or other sources—by marking the appropriate box.

04

Provide your total expected payments for the year to help calculate your withholding correctly.

05

Determine if you want extra withholding by specifying an additional amount in the designated section.

06

Review your completed form for accuracy and sign where required before submitting it to your payer.

Guidelines for Completing the IRS W-4P Form

When filling out the W-4P form, it is essential to provide accurate forecasts of your anticipated income. If your income changes during the year, you can submit a new W-4P to adjust your withholding accordingly. Always remember to keep a copy for your records. Additionally, if you choose to claim exemption from withholding, you must meet specific criteria, which must be certified annually.

Show more

Show less

Recent Amendments and Modifications to IRS W-4P

Recent Amendments and Modifications to IRS W-4P

Several important updates have been made to the IRS W-4P recently. These changes include adjustments to the withholding calculations and the introduction of new guidelines regarding exemptions. For example, modifications in payment thresholds affect who can claim exemption from withholding, which is particularly relevant for higher-income earners.

Essential Insights about the IRS W-4P Form

What Exactly is the IRS W-4P?

Why is the IRS W-4P Important?

Who is Required to Complete the W-4P Form?

When is Exemption Applicable on the W-4P?

What Does the IRS W-4P Include?

Filing Deadline for IRS W-4P

Comparing the W-4P with Similar Forms

What Transactions Are Captured by the W-4P?

Number of Copies Required for Submission

Understanding Penalties for Not Submitting the W-4P

Information Needed for Filing the IRS W-4P

Other Forms that May Accompany the W-4P

Where to Submit the IRS W-4P

Essential Insights about the IRS W-4P Form

What Exactly is the IRS W-4P?

The IRS W-4P form is a withholding certificate specifically designed for pension or annuity recipients. It facilitates the reporting and calculation of the amount of federal income tax that should be deducted from these payments, thereby helping taxpayers avoid underpayment penalties.

Why is the IRS W-4P Important?

This form plays a critical role in tax compliance for retirees or individuals receiving certain types of payments. By submitting a W-4P, you can align tax withholding with your expected income from these sources, reducing the likelihood of receiving a tax bill during the filing season.

Who is Required to Complete the W-4P Form?

Any individual receiving pension or annuity payments should complete the W-4P form. This includes retirees, beneficiaries of annuities, and anyone with similar income streams. If you expect to receive retirement income regularly, filling out this form is essential for accurate tax withholding.

When is Exemption Applicable on the W-4P?

Exemption from withholding on the W-4P applies if your expected tax liability for the year is zero or if you were entitled to a refund of all federal income tax withheld in the previous year. Qualifying conditions include:

01

Having no tax liability last year and expecting none this year.

02

Receiving only tax-exempt income.

03

Being below the income thresholds set by the IRS for age-based exemptions.

What Does the IRS W-4P Include?

The form consists of various components such as personal information, types of payments received, total expected payments, and sections for additional withholding. It also has a section for claiming exemption from withholding if eligible, along with necessary signatures and dates.

Filing Deadline for IRS W-4P

Typically, the W-4P must be submitted to your payer before the beginning of the tax year, although it can be submitted anytime during the year if adjustments are necessary. Be aware that quick submissions can impact your withholding starting from the next payment cycle.

Comparing the W-4P with Similar Forms

The IRS W-4P is often compared to forms such as the W-4 and W-2. While the W-4 is for wage earners to specify withholding on employment income, the W-2 summarizes annual earnings and tax withheld. In contrast, the W-4P is specifically tailored for recipients of pensions or annuities.

What Transactions Are Captured by the W-4P?

The W-4P primarily covers pension payments, annuities, and certain retirement distributions. This includes payments from 401(k) plans, IRAs, and other defined benefit plans. Each type of transaction may have unique implications regarding tax withholding based on the specifics of the plan.

Number of Copies Required for Submission

When submitting the W-4P, typically one copy is required to be sent to your payer. However, it is advisable to retain a copy for your records to ensure you have a reference for future adjustments or inquiries.

Understanding Penalties for Not Submitting the W-4P

Failure to submit the W-4P can lead to significant penalties, including:

01

Underpayment penalties if your income tax withholding is insufficient.

02

Financial repercussions resulting in interest charges on unpaid taxes.

03

Potential legal consequences if the lack of compliance is deemed negligent.

Information Needed for Filing the IRS W-4P

When completing the W-4P, you'll need the following information:

01

Your full name, address, and Social Security number.

02

Details about your retirement or annuity payments, including amounts and frequency.

03

Previous year’s tax return information for accurate liability forecasting.

Other Forms that May Accompany the W-4P

If you are submitting the W-4P, you may also need to include the IRS 1040 form along with any relevant schedules that document sources of income or deductions applicable to your tax situation.

Where to Submit the IRS W-4P

The completed W-4P should be sent directly to your pension plan administrator or the financial institution managing your annuity. Ensure you check for specific submission addresses or online processing options that may be available by consulting with your payer.

By understanding the intricacies of the IRS W-4P, you empower yourself to make informed tax decisions. Take control of your withholdings today and consider consulting with a tax professional to optimize your financial position.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It takes a few minutes to sort things out, but overall it's very helpful

I have just started using the service, but so far, so good.

Try Risk Free